The Best Guide To Transaction Advisory Services

Table of ContentsSome Known Questions About Transaction Advisory Services.Everything about Transaction Advisory ServicesGetting The Transaction Advisory Services To WorkThe smart Trick of Transaction Advisory Services That Nobody is Talking AboutThe Single Strategy To Use For Transaction Advisory Services

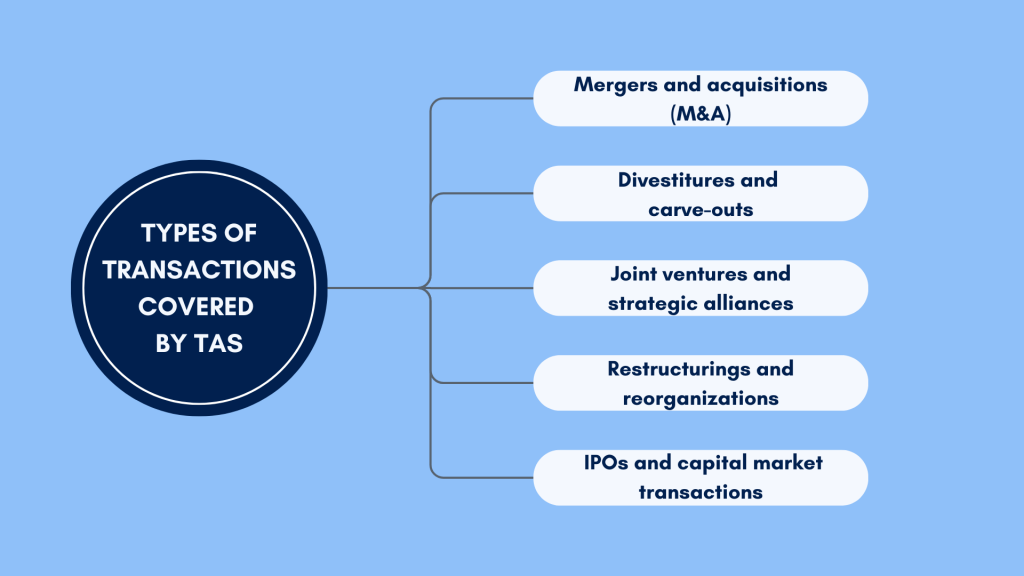

This step ensures the organization looks its best to possible buyers. Obtaining business's worth right is important for a successful sale. Advisors use various approaches, like affordable capital (DCF) evaluation, comparing to comparable business, and recent deals, to determine the fair market price. This helps set a reasonable cost and negotiate successfully with future customers.Transaction advisors step in to assist by obtaining all the required details organized, addressing questions from buyers, and setting up check outs to the business's location. This develops depend on with purchasers and maintains the sale relocating along. Obtaining the very best terms is essential. Deal experts utilize their expertise to help company owner manage challenging arrangements, fulfill customer assumptions, and framework bargains that match the proprietor's objectives.

Fulfilling legal rules is essential in any kind of service sale. Deal advisory solutions deal with lawful professionals to develop and examine contracts, arrangements, and various other legal documents. This decreases threats and makes certain the sale follows the regulation. The role of purchase experts extends past the sale. They assist company owner in preparing for their next actions, whether it's retirement, beginning a brand-new venture, or handling their newfound wide range.

Transaction consultants bring a riches of experience and expertise, making certain that every aspect of the sale is taken care of expertly. With strategic preparation, assessment, and arrangement, TAS helps local business owner attain the highest possible list price. By making certain legal and regulatory conformity and handling due persistance along with other deal employee, transaction advisors reduce prospective dangers and obligations.

The Best Guide To Transaction Advisory Services

By contrast, Large 4 TS teams: Deal with (e.g., when a possible customer is carrying out due persistance, or when a deal is closing and the customer needs to integrate the business and re-value the vendor's Annual report). Are with charges that are not connected to the deal closing efficiently. Earn fees per interaction someplace in the, which is less than what investment banks earn also on "tiny deals" (however the collection chance is likewise a lot greater).

, but they'll concentrate more on accounting and evaluation and less on subjects like LBO modeling., and this hyperlink "accountant only" topics like trial equilibriums and exactly how to stroll through occasions using debits and credit scores instead than financial declaration changes.

Some Known Questions About Transaction Advisory Services.

Specialists in the TS/ FDD groups may likewise speak with monitoring regarding whatever over, and they'll create a detailed record with their searchings for at the end of the process.

, and the basic form looks like this: The entry-level role, where you do a great deal of data and economic evaluation (2 years for a promo from right here). The following degree up; similar job, yet you obtain the more intriguing little bits (3 years for a promotion).

Particularly, it's difficult to obtain promoted past the Manager degree since couple of people leave the task at that phase, and you require to start revealing proof of your capability to generate profits to development. Allow's start with the hours and way of living because those are easier to explain:. There are periodic late nights and weekend job, but absolutely visit the site nothing like the agitated nature of financial investment banking.

There are cost-of-living changes, so expect reduced compensation if you're in a less costly area outside significant financial centers. For all settings other than Companion, the base wage makes up the bulk of the complete payment; the year-end reward may be a max of 30% of your base pay. Usually, the most effective means to increase your incomes is to switch to a different firm and work out for a greater salary and benefit

Facts About Transaction Advisory Services Uncovered

At this stage, you must just remain and make a run for a Partner-level duty. If you want to leave, perhaps move to a client and do their valuations and due diligence in-house.

The main trouble is that because: You normally require to join another Huge 4 group, such as audit, and job there for a couple of years and after that move right into TS, work there for a few years and afterwards move into IB. And there's still no guarantee of winning this IB duty since it depends upon your area, clients, and the employing market at the time.

Longer-term, there is also some danger of and due to the fact that assessing a firm's historic monetary information is not exactly brain surgery. Yes, human beings will certainly always require to be entailed, yet with advanced technology, lower head counts could potentially sustain customer interactions. That said, the Purchase Solutions group defeats audit in terms of pay, job, and exit possibilities.

If you liked this write-up, you may be thinking about analysis.

How Transaction Advisory Services can Save You Time, Stress, and Money.

Create advanced monetary frameworks that aid in identifying the actual market worth of a firm. Offer advisory work in relation to business valuation from this source to assist in negotiating and pricing frameworks. Explain one of the most appropriate type of the bargain and the type of consideration to use (money, supply, earn out, and others).

Carry out assimilation preparation to figure out the process, system, and organizational modifications that might be needed after the offer. Establish guidelines for integrating departments, technologies, and service procedures.

Evaluate the prospective client base, sector verticals, and sales cycle. The operational due persistance uses crucial insights right into the performance of the firm to be acquired concerning risk assessment and worth development.